Client Context

EnerVision, Inc. is a management consulting firm founded in 1997 that focuses on energy related practices pertinent to electric utilities that yield over 5 million dollars in revenue annually. The firm provides a wide variety of professional services including Power Supply Planning and Integrated Resource Planning as many of their clients are energy utility companies.

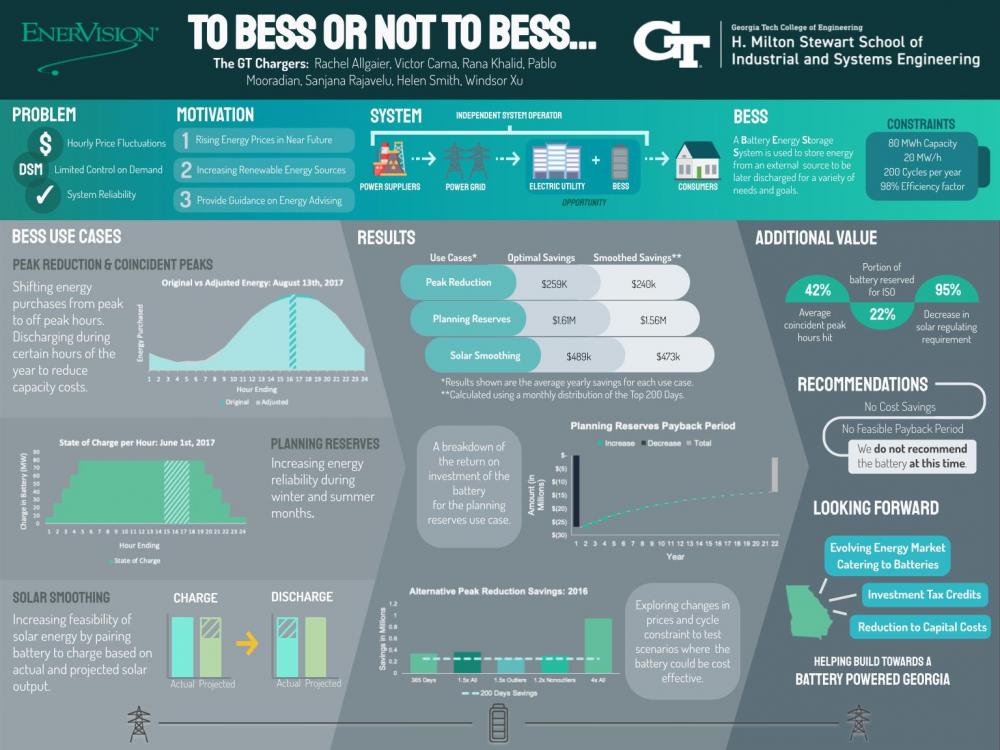

We are studying the various aspects of the pricing and usage of electricity from the perspective of a single electric utility in Georgia. The flow of electricity in the electrical grid is heavily dependent on the amount of load or demand that is exerted upon it. Electric utilities obtain energy from various sources, but if the electricity demand is too high, they must purchase it directly from the market. The market energy price fluctuates throughout each day, resulting in peak price hours and off-peak price hours.

Project Objective

The goal of this project is to present EnerVision’s clients with a business case (on an individual basis) for or against the addition of a grid scale battery to their energy purchase and distribution system. Delivering this business case will provide justification for the client to either adopt a BESS, knowing it will be a worthwhile investment, or explore other options to reduce system costs and increase system reliability.

There are three main motivations we have to solve this problem. First, energy prices are expected to rise in the near future. Restrictions in oil and natural gas supplies are translated into increasing electricity prices. In an attempt to mitigate this, savings need to be found wherever possible. Second, many countries are making efforts to utilize more renewable energy within their electrical generation capacities. This business case is needed to help utility companies implement their policies in an informed manner. Lastly, we are looking to provide additional information to aid system operators when it comes to implementing and creating policies for grid-level batteries and their use in the overall system.

Design Strategy

In order to understand how BESSs are currently used and the best use case scenarios for a BESS in the scope of this system, a comprehensive literature review of the battery energy market was completed. The next step involved understanding and cleaning an electric utility’s data: hourly historical pricing, electricity load, and solar energy outputs for the years 2016-2020 and understanding the constraints of the BESS. Using this data, an algorithm was then created to explore the three different ways the BESS can be charged and discharged throughout a year to get the most cost saving benefits. The three use cases focused on in this project are as follows:

- Peak Reduction & Coincident Peaks: Offsetting electricity consumption during peak demand hours using stored energy and gaining additional savings by reducing load contribution during coincident peak hours.

- Planning Reserves: Increasing energy reliability based on seasonal constraints and hourly requirements by reserving energy in the battery during set hours for the system operator to use.

- Solar Smoothing: Mitigating hourly variance associated with solar output due to cloud cover, rain, thunderstorms, etc. in order to reduce regulatory requirement costs regarding variance.

Using the savings from the different use cases, the period of time in which the BESS would pay for itself, otherwise known as the payback period, was calculated.

The algorithm and results were validated by verifying the appropriate implementation of the different use cases of the BESS with our client and by utilizing benchmark maximum savings to confirm the accuracy of the calculated savings of our algorithm for all use cases.

Deliverables

- Algorithm User Interface: Hosts the algorithm tool used in determining the BESS yearly utilization. The output of the algorithm includes a historical charging schedule and yearly costs and savings.

- BESS Yearly Utilization: The optimal charging and discharging of the BESS in a given year determined using the algorithm tool.

- Business Case: Justification for or against the purchase and use of a BESS.

- BESS Cost Savings: A summary of the yearly BESS cost savings calculated from the BESS yearly utilization in the algorithm tool.

- Payback Period Calculation: The period of time in which the EMC will break even on the investment for the BESS according to the BESS cost savings summary and Power Purchase Agreement.

- We found there is no use case for the BESS that results in a feasible payback period within the 20 year BESS contract.

- Final recommendation: At this time, we advise EnerVision to not recommend the BESS to their clients, as it is currently not an economically feasible opportunity.