Client Context

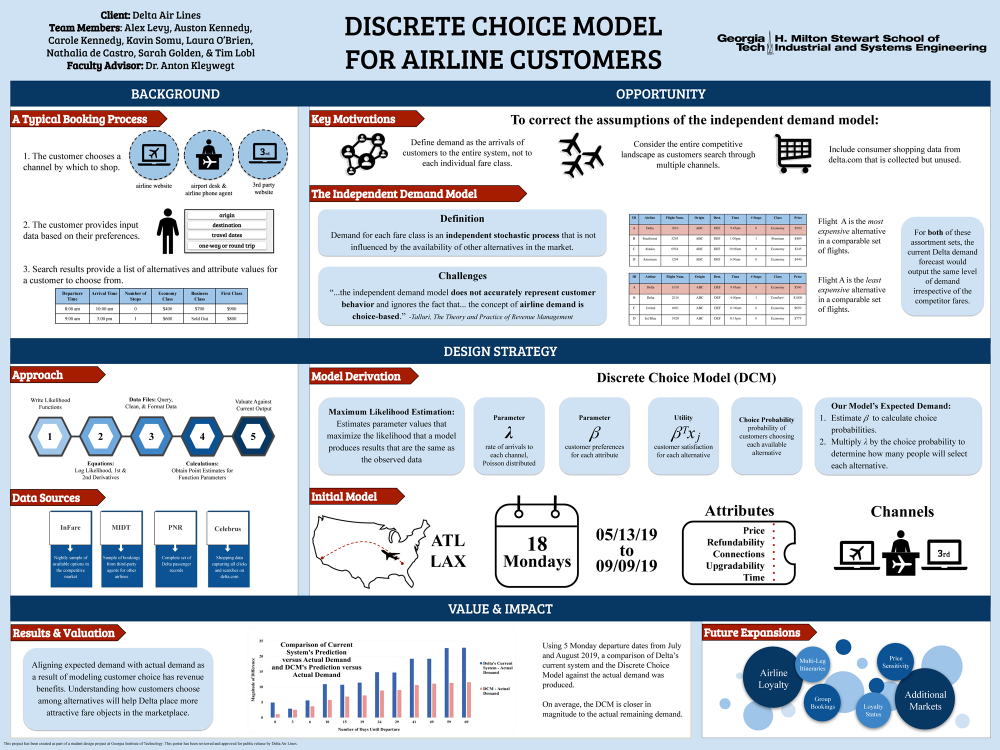

The client, Delta Air Lines headquartered in Atlanta, GA, is the second-largest passenger airline in the world operating through 6 continents. Specifically, the Revenue Management team is responsible for creating the demand forecast for all 927 Delta leg markets. The current forecasting system, known as DYMOnD, follows the independent demand model. This means that it predicts demand for a single flight for a single fare class rather than looking at all other fare classes, flights, and the competitive landscape as a whole.

Project Objective

The assumptions of the independent demand model do not align with a typical customer’s booking process, as one may search on various channels to gain a complete picture of the available options before making a purchase. Normally, a customer will input preferences (departure date, origin and destination location) and search for the flight that best fits their needs depending upon what is available. For example, a price sensitive customer may choose a $200 option if that is the cheapest available; however, if a $100 alternative becomes available they will choose that instead. The independent demand model does not consider which other alternatives are available to a customer. Instead, it predicts demand independent of the availability of other options.

Design Strategy

To mitigate the incorrect assumptions associated with the independent demand model, a discrete choice model was created. First, an assortment set was defined as all alternatives available to a customer searching on a particular channel for a given departure date on a certain number of days before departure. Then, using the multinomial logit model, the probability of customers choosing each of the alternatives in that assortment set can be calculated, summing to 1. This is completed following the idea of utility maximization, as customers are more likely to choose an alternative that provides them greater utility, or satisfaction. A predicted utility for each alternative is calculated using values for different attributes (price, departure time, refundability, upgradability, number of stops) and the customer weights corresponding to the attributes. Customer weights, in the form of a beta vector, are predicted using a maximum likelihood estimation equation. Arrival rates, or the estimated arrivals per day written in the form of a lambda vector, are the other variable predicted using maximum likelihood estimation. Multiplying the probability of a customer choosing a specific alternative by the estimated number of arrivals to that alternative provides an estimated number of people who choose each alternative in the assortment set.

Deliverables

The deliverable that provided to the client is a proof-of-concept detailing the discrete choice modeling procedure for the Atlanta to Los Angeles market. This was done using data for 18 Monday departure dates between May and September of 2019, with 6 of the data points used for model calibration and the remaining 12 of the data points used for model testing. Our recommendation is for Delta to establish a new team solely focused on implementing a discrete choice model as the demand forecast for different markets. This proof-of-concept illustrates a new way to forecast demand that does not follow the independent demand model and its incorrect assumptions.